In the intricate tapestry of global finance, few narratives have captured the complexity and intrigue of economic systems as effectively as “The Big Short.” This article aims to dissect the multifaceted world of finance as depicted in the book and its subsequent film adaptation, providing a comprehensive analysis of the events leading up to the 2008 financial crisis. Through a detailed examination of the key players, financial instruments, and market dynamics, we will explore how this compelling story illuminates the often opaque mechanisms of modern finance. By breaking down the intricate details and broader implications, this analysis seeks to offer readers a clearer understanding of the systemic vulnerabilities and human behaviors that precipitated one of the most significant economic downturns in recent history.

Understanding the Financial Instruments Depicted in The Big Short

The 2015 film “The Big Short” masterfully brings to light a variety of complex financial instruments that played pivotal roles in the 2008 financial crisis. Understanding these instruments is crucial for grasping the film’s narrative and the real-life events it depicts. Among the key instruments highlighted are mortgage-backed securities (MBS), collateralized debt obligations (CDO), and credit default swaps (CDS). These instruments, while innovative, contributed significantly to the economic turmoil due to their risky nature and the lack of transparency in their trading.

- Mortgage-Backed Securities (MBS): These are bundles of home loans sold as securities, offering returns to investors as homeowners make their mortgage payments. The film illustrates how the overvaluation of these securities, based on risky subprime mortgages, led to widespread defaults.

- Collateralized Debt Obligations (CDO): CDOs are complex derivatives that pool various debt assets, including MBS. “The Big Short” shows how CDOs repackaged subprime mortgages into tranches, falsely rated as low-risk, which amplified the crisis when the housing market collapsed.

- Credit Default Swaps (CDS): These are essentially insurance contracts against the default of a borrower. The protagonists in the film use CDS to bet against the failing housing market, showcasing their understanding of the impending financial meltdown.

Through these financial instruments, the film not only entertains but also educates viewers on the intricacies of the financial system and the cascading effects of its collapse. Understanding these concepts is crucial for anyone looking to comprehend the factors that led to one of the most significant economic downturns in recent history.

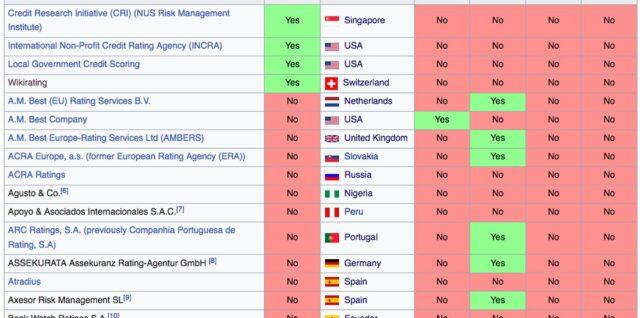

Analyzing the Role of Credit Rating Agencies and Their Impact

Credit rating agencies play a pivotal role in the financial ecosystem, acting as gatekeepers of creditworthiness and influencing investment decisions worldwide. Their assessments, often perceived as objective, can significantly impact a country’s or corporation’s ability to borrow funds. However, the methodologies and motivations behind these ratings are not always transparent. Understanding their influence requires delving into several key areas:

- Influence on Interest Rates: Ratings directly affect the interest rates that entities pay on their debt. Higher ratings typically mean lower borrowing costs, while downgrades can lead to substantial financial strain.

- Market Reactions: Announcements of upgrades or downgrades can lead to swift market reactions, influencing stock prices and investor confidence. This volatility can create opportunities for profit but also risks for stakeholders.

- Potential Conflicts of Interest: As these agencies are often paid by the entities they rate, questions arise regarding the impartiality of their evaluations, especially when considering the events leading up to the 2008 financial crisis.

In scrutinizing the power and responsibility held by credit rating agencies, it becomes clear that their impact extends beyond mere numbers. Their assessments shape the financial landscape, affecting everything from individual investor portfolios to the stability of global markets. As such, a critical analysis of their operations and accountability mechanisms remains essential for fostering a more resilient financial system.

Exploring the Behavioral Economics Behind Financial Decisions

In the intricate realm of finance, understanding the role of behavioral economics is pivotal to decoding why individuals often make seemingly irrational financial decisions. Behavioral economics blends insights from psychology with economic theory to explain why people sometimes act against their own best interests. For instance, the concept of loss aversion reveals that individuals are more sensitive to losses than gains, which can lead to overly conservative investment choices or panic selling during market downturns. Similarly, herd behavior can trigger market bubbles, as investors collectively follow trends without independent evaluation, resulting in inflated asset prices.

- Overconfidence: Many investors overestimate their knowledge and ability to predict market movements, leading to excessive risk-taking.

- Anchoring: Initial information or price points can unduly influence decisions, causing investors to cling to outdated or irrelevant data.

- Confirmation Bias: Investors often seek information that confirms their existing beliefs, ignoring data that contradicts their preconceptions.

Understanding these behavioral patterns is crucial for both individual investors and financial institutions. By recognizing and mitigating the influence of these biases, stakeholders can make more informed decisions, fostering a more stable and efficient financial market. The study of behavioral economics not only provides a lens through which to view past financial crises but also offers a toolkit for preventing future ones.

Recommendations for Navigating Modern Financial Markets

In the intricate dance of modern financial markets, understanding and adaptability are key. To successfully navigate this ever-evolving landscape, consider adopting a multi-faceted approach. Diversification remains a cornerstone of any robust investment strategy. By spreading your investments across various asset classes, you mitigate risks and position yourself to capitalize on a wider range of opportunities. Additionally, staying informed is crucial. Regularly engage with reliable financial news sources and analytical reports to keep abreast of market trends and shifts.

- Embrace Technology: Utilize advanced trading platforms and analytical tools to gain deeper insights and execute informed decisions.

- Focus on Long-term Goals: Short-term market fluctuations can be unpredictable; maintaining a long-term perspective can help in weathering volatility.

- Risk Management: Implement strategies such as stop-loss orders and portfolio rebalancing to protect against significant losses.

- Seek Professional Advice: Consulting with financial advisors can provide personalized insights and strategies tailored to your unique financial situation.